Keyword: Student Loan Debt Spelling: American English 670 Words

Meta Description: Are you finding it challenging to pay off your student loan debt? If so, you're not alone! Here are three quick tips to pay off these debts!

If you have student loan debt, know that you are not alone! Over 55% of students from four-year public institutions had student loans, which climbs to 57% for private nonprofit institutions. The average student debt per borrower is $28,000, steadily rising as college costs increase. Many people, especially recent graduates, feel this debt is crippling. It hinders the ability to buy a home, move out of a family home, or buy a car. Fortunately, there are strategies you can use to manage this debt. Let's explore three of the best (and easiest) ones!

Almost all student loan debt is federal. Indeed, the federal government owns 92% of this type of debt, so if you're reading this post, there's a good chance you have a federal loan.

The federal government has many programs, like income-based repayment plans, loan forgiveness options, and loan payment assistance programs. Each of these aims to make student loans more affordable for borrowers, and many have the option of eventual relief. Be careful of the tax consequences of having student loans forgiven - the IRS typically treats this forgiveness as income, so if you have $10,000 forgiven, that's the same as earning an extra $10,000 in income, which could result in a significant tax bill!

One of the more popular programs is the Pay as You Earn Repayment Plan (PAYE). This plan limits the amount of your student loan to no more than 10% of your discretionary income. In some versions of this plan, any amount still not paid after 20 years is forgiven. This plan is likely your best bet if you're looking to free up more of your monthly cash flow!

While student loans may be a sizable portion of your income, in addition to seeking relief opportunities, it's also essential to understand your financial picture. Take inventory of your income and expenses, including your loans, to see where your money is going. There may be some small areas where you can cut to free up some additional money to either pay your student loans off faster or provide a little bit more discretionary income.

Combined with a repayment plan, this technique can be potent, as you limit the amount you contribute each month to your student loan debt while simultaneously maximizing the amount you can pay each month. In other words, you can use your budget to reach your savings goals (e.g., an emergency fund of six months of expenses saved), and then once you have a comfortable nest egg, you can use that extra money to pay your student loans faster!

Both the federal government and private lenders have options for consolidating loans. Typically, if you can get it, the federal government will have more favorable terms for consolidation.

Please remember that loan consolidation frequently increases the amount of time you'll spend paying off the loan and usually increases the amount of interest you will pay. For example, if you have a 15-year loan at 4% that you are five years into paying and a 10-year loan at 5% that you are five years into paying, you might consolidate that to a 10-year 4.5% loan. Your monthly payments will be lower since you have amortized the same principal over ten years instead of five, but the interest you will pay is more.

Still, if you're looking for some relief, you may wish to consider loan consolidation!

Regarding student loan debt, please remember that you can conquer it! With a repayment program or a loan consolidation (or both), you can lower your monthly payments to a more manageable state. And, with a proper budget, you can ensure that you can allocate an appropriate level of funds towards paying this debt down quickly.

Bottom line: your student loans needn't be an unnecessary burden! You can put your student loan debt in the rear-view mirror with perseverance and the right financial maneuvers!

We include four reports with every delivery at Blue Turtle. These reports ensure the post is grammatically correct, free of plagiarism, SEO-friendly, and that people are likely to share it on social media.

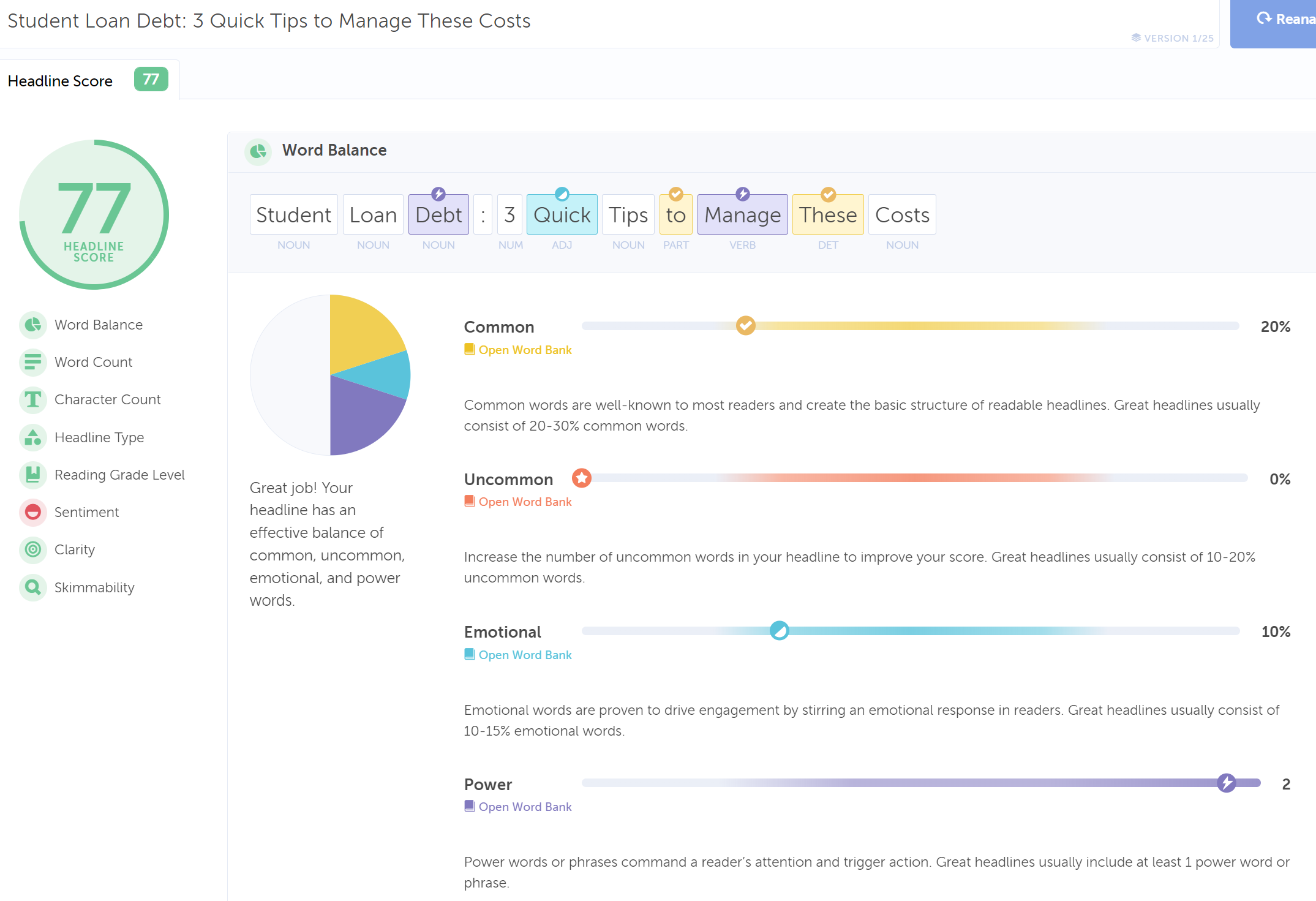

We include a report from Headline Analyzer, a tool from CoSchedule which ranks headlines for

traits that make them more likely to be shared on social media.

We include the output of Da

Vinci, an OpenAI model that provides a fantastic basis for a blog post.

Included with every report is an analysis by Yoast, a popular SEO tool for WordPress sites.

Lastly, we include a report from Grammarly, attesting to the fact that the post is

plagiarism-free and grammatically correct.